Accounting Journal Entries With Gst . the accounting entries for setting off the tax liabilities with credit is as follows. Assuming that both parties belong to. Conquer gst filing with clear explanations & downloadable examples! What new needs to be done in accounting for gst?. master gst journal entries: how to pass accounting entries in gst? Cgst, sgst and igst are treated differently while calculating in your books of. pass journal entries for the following transactions in the books of sahil ltd. in this section, we will see the major accounting entries to be generated under gst along with the new ledger. learn about gst accounting and entries in india, and how you must maintain your records for sales and purchase transactions from zoho. Check out the examples of few payment. Simple guides for sales, purchases & payments. find out how to pass accounting entries for gst payment, gst itc reconciliation etc.

from www.teachoo.com

master gst journal entries: in this section, we will see the major accounting entries to be generated under gst along with the new ledger. find out how to pass accounting entries for gst payment, gst itc reconciliation etc. What new needs to be done in accounting for gst?. pass journal entries for the following transactions in the books of sahil ltd. Simple guides for sales, purchases & payments. learn about gst accounting and entries in india, and how you must maintain your records for sales and purchase transactions from zoho. Cgst, sgst and igst are treated differently while calculating in your books of. Check out the examples of few payment. Assuming that both parties belong to.

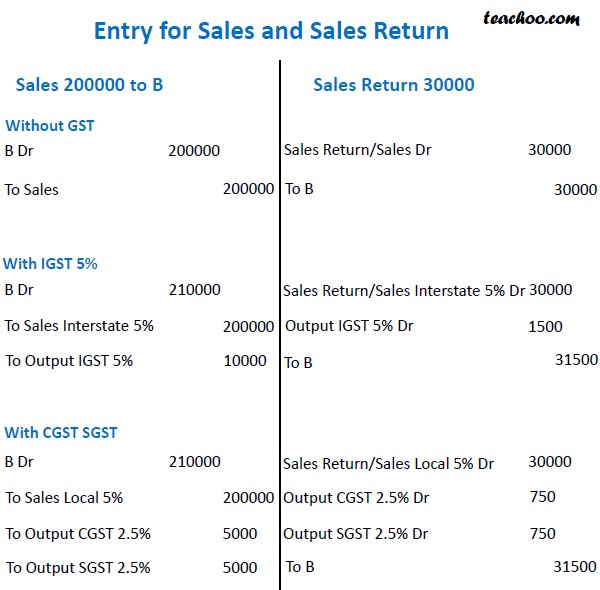

Entry for Sales and Sales Return with and Without GST Chapter 4 GST

Accounting Journal Entries With Gst learn about gst accounting and entries in india, and how you must maintain your records for sales and purchase transactions from zoho. pass journal entries for the following transactions in the books of sahil ltd. master gst journal entries: the accounting entries for setting off the tax liabilities with credit is as follows. Conquer gst filing with clear explanations & downloadable examples! learn about gst accounting and entries in india, and how you must maintain your records for sales and purchase transactions from zoho. in this section, we will see the major accounting entries to be generated under gst along with the new ledger. find out how to pass accounting entries for gst payment, gst itc reconciliation etc. Assuming that both parties belong to. Check out the examples of few payment. What new needs to be done in accounting for gst?. Cgst, sgst and igst are treated differently while calculating in your books of. how to pass accounting entries in gst? Simple guides for sales, purchases & payments.

From www.youtube.com

GST and Journal Entry Class 11 Accountancy Chapter3 (Part10 Accounting Journal Entries With Gst how to pass accounting entries in gst? in this section, we will see the major accounting entries to be generated under gst along with the new ledger. the accounting entries for setting off the tax liabilities with credit is as follows. What new needs to be done in accounting for gst?. Conquer gst filing with clear explanations. Accounting Journal Entries With Gst.

From www.youtube.com

GST Input Tax Credit ITC Accounting Journal Entries with EXAMPLES Accounting Journal Entries With Gst how to pass accounting entries in gst? learn about gst accounting and entries in india, and how you must maintain your records for sales and purchase transactions from zoho. master gst journal entries: Check out the examples of few payment. pass journal entries for the following transactions in the books of sahil ltd. Cgst, sgst and. Accounting Journal Entries With Gst.

From dkgoelsolutions.com

DK Goel Solutions Class 11 Chapter 10 as per latest DK Goel Book Accounting Journal Entries With Gst learn about gst accounting and entries in india, and how you must maintain your records for sales and purchase transactions from zoho. pass journal entries for the following transactions in the books of sahil ltd. find out how to pass accounting entries for gst payment, gst itc reconciliation etc. Simple guides for sales, purchases & payments. . Accounting Journal Entries With Gst.

From byjus.com

DK Goel Solutions for Class 11 Accountancy Chapter 10 Accounting for Accounting Journal Entries With Gst find out how to pass accounting entries for gst payment, gst itc reconciliation etc. Assuming that both parties belong to. Conquer gst filing with clear explanations & downloadable examples! pass journal entries for the following transactions in the books of sahil ltd. Cgst, sgst and igst are treated differently while calculating in your books of. learn about. Accounting Journal Entries With Gst.

From www.teachoo.com

Entries for Purchase with and without GST Chapter 4 GST Entries Accounting Journal Entries With Gst in this section, we will see the major accounting entries to be generated under gst along with the new ledger. learn about gst accounting and entries in india, and how you must maintain your records for sales and purchase transactions from zoho. pass journal entries for the following transactions in the books of sahil ltd. find. Accounting Journal Entries With Gst.

From www.youtube.com

how to make gst accounting entries YouTube Accounting Journal Entries With Gst learn about gst accounting and entries in india, and how you must maintain your records for sales and purchase transactions from zoho. pass journal entries for the following transactions in the books of sahil ltd. find out how to pass accounting entries for gst payment, gst itc reconciliation etc. Assuming that both parties belong to. the. Accounting Journal Entries With Gst.

From www.teachoo.com

How to Pass GST Entries in Tally Teachoo Accounting Entries in GST Accounting Journal Entries With Gst Cgst, sgst and igst are treated differently while calculating in your books of. Assuming that both parties belong to. What new needs to be done in accounting for gst?. learn about gst accounting and entries in india, and how you must maintain your records for sales and purchase transactions from zoho. in this section, we will see the. Accounting Journal Entries With Gst.

From www.youtube.com

Class11,Journal entries(Accounting for goods and services Tax),GST Accounting Journal Entries With Gst Check out the examples of few payment. Cgst, sgst and igst are treated differently while calculating in your books of. Conquer gst filing with clear explanations & downloadable examples! learn about gst accounting and entries in india, and how you must maintain your records for sales and purchase transactions from zoho. the accounting entries for setting off the. Accounting Journal Entries With Gst.

From charteredindia.com

How to Record GST Transactions in Accounts Journal Entries Accounting Journal Entries With Gst Assuming that both parties belong to. Cgst, sgst and igst are treated differently while calculating in your books of. master gst journal entries: pass journal entries for the following transactions in the books of sahil ltd. Check out the examples of few payment. the accounting entries for setting off the tax liabilities with credit is as follows.. Accounting Journal Entries With Gst.

From mavink.com

Perpetual Inventory System Journal Entry Accounting Journal Entries With Gst find out how to pass accounting entries for gst payment, gst itc reconciliation etc. Conquer gst filing with clear explanations & downloadable examples! Simple guides for sales, purchases & payments. Check out the examples of few payment. master gst journal entries: Cgst, sgst and igst are treated differently while calculating in your books of. pass journal entries. Accounting Journal Entries With Gst.

From www.youtube.com

GST Concept for Journal entry Accounting Part 5 YouTube Accounting Journal Entries With Gst Cgst, sgst and igst are treated differently while calculating in your books of. in this section, we will see the major accounting entries to be generated under gst along with the new ledger. Simple guides for sales, purchases & payments. What new needs to be done in accounting for gst?. pass journal entries for the following transactions in. Accounting Journal Entries With Gst.

From www.svtuition.org

Journal Entries for GST Accounting Education Accounting Journal Entries With Gst the accounting entries for setting off the tax liabilities with credit is as follows. find out how to pass accounting entries for gst payment, gst itc reconciliation etc. Assuming that both parties belong to. master gst journal entries: Simple guides for sales, purchases & payments. how to pass accounting entries in gst? learn about gst. Accounting Journal Entries With Gst.

From quickbooks.intuit.com

Create GST Inclusive Journal Entries Accounting Journal Entries With Gst learn about gst accounting and entries in india, and how you must maintain your records for sales and purchase transactions from zoho. how to pass accounting entries in gst? Conquer gst filing with clear explanations & downloadable examples! in this section, we will see the major accounting entries to be generated under gst along with the new. Accounting Journal Entries With Gst.

From www.studocu.com

Example of GST on sale of a NCA Solution ACCT10002 Lecture 11 Accounting Journal Entries With Gst master gst journal entries: the accounting entries for setting off the tax liabilities with credit is as follows. learn about gst accounting and entries in india, and how you must maintain your records for sales and purchase transactions from zoho. What new needs to be done in accounting for gst?. Conquer gst filing with clear explanations &. Accounting Journal Entries With Gst.

From quickbooks.intuit.com

How to use Excel for accounting and bookkeeping QuickBooks Accounting Journal Entries With Gst Assuming that both parties belong to. find out how to pass accounting entries for gst payment, gst itc reconciliation etc. learn about gst accounting and entries in india, and how you must maintain your records for sales and purchase transactions from zoho. pass journal entries for the following transactions in the books of sahil ltd. Simple guides. Accounting Journal Entries With Gst.

From www.meteorio.com

Learn Accounting Entries Under GST with Journal Entry [RCM] Meteorio Accounting Journal Entries With Gst Conquer gst filing with clear explanations & downloadable examples! Check out the examples of few payment. Assuming that both parties belong to. Simple guides for sales, purchases & payments. Cgst, sgst and igst are treated differently while calculating in your books of. in this section, we will see the major accounting entries to be generated under gst along with. Accounting Journal Entries With Gst.

From www.teachoo.com

Entry for Expenses if ITC Available or Not Chapter 4 GST Entries Accounting Journal Entries With Gst master gst journal entries: the accounting entries for setting off the tax liabilities with credit is as follows. in this section, we will see the major accounting entries to be generated under gst along with the new ledger. learn about gst accounting and entries in india, and how you must maintain your records for sales and. Accounting Journal Entries With Gst.

From www.youtube.com

03 GST ITC Set Off Rules And Journal Entries GST Payment Journal Accounting Journal Entries With Gst Simple guides for sales, purchases & payments. the accounting entries for setting off the tax liabilities with credit is as follows. learn about gst accounting and entries in india, and how you must maintain your records for sales and purchase transactions from zoho. Assuming that both parties belong to. What new needs to be done in accounting for. Accounting Journal Entries With Gst.